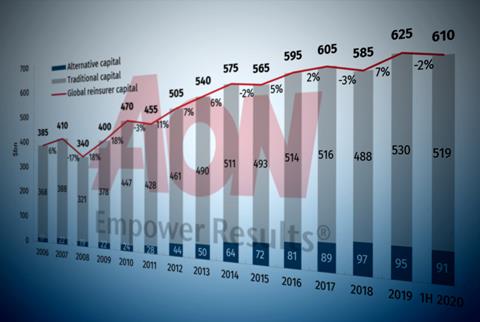

CAPITAL OF TOP REINSURERS REBOUNDS TO 2019 LEVELS

Source: asiainsurancereview.com

The capital base of the world’s leading reinsurers has remained resilient, after a strong capital markets recovery in the second quarter of this year, says Aon’s Reinsurance Aggregate (ARA) report. The capital has rebounded to 2019 levels.

Aon recently announced the launch of its latest ARA report, which analyses the financial performance of 23 of the world’s leading reinsurers in the first half of 2020, including Alleghany, Arch, Argo, Aspen, AXIS, Beazley, Everest Re, Fairfax, Hannover Re, Hiscox, Lancashire, Mapfre, Markel, Munich Re, PartnerRe, QBE, Qatar Insurance, RenRe, SCOR, Sirius, Swiss Re, Third Point Re and W.R. Berkley. The ARA group of reinsurers underwrites approximately 50% of the world’s non-life reinsurance premiums, and a large majority of the life reinsurance premiums, making their dynamics a reasonable proxy for the reinsurance sector as a whole.

The impact of the novel coronavirus (COVID-19) dominated the ARA’s financial results in the first half of 2020. Underwriting results were undermined by reserves established for associated claims, while investment returns showed the effects of the extreme capital market volatility experienced in March. Consequently, an overall loss was sustained for the period. However, the capital base has remained resilient.

Total ARA capital stood at $255bn at 30 June 2020, unchanged relative to the end of 2019, split equity $201bn (-1%) and debt $54bn (+6%). Approximately $3.7bn of new equity issuance in the period was out-weighed by dividends and share buybacks of $6.8bn.

Property and casualty (P&C) insurance and reinsurance gross premiums written (GPW) rose by 5% to $114bn, assisted by risk-adjusted renewal rate increases. P&C insurance and reinsurance net premiums earned rose by 6% to $84bn.

Life and health reinsurance GPW stood at $25bn. This segment generated additional COVID-19-related losses of $1bn.

The net combined ratio stood at 104.1%, split losses 72.8% and expenses 31.3%. COVID-19-related losses of $8.2bn contributed 9.7 percentage points (pp) and natural catastrophe losses added another 2.8pp. Prior-year reserve releases provided 0.6pp of benefit. The net loss for the period was $1.1bn, representing an annualised return on equity of -1.5%.

Mr Mike Van Slooten, head of business intelligence for Aon’s Reinsurance Solutions business and author of the ARA report, said, “While it is already clear that the ARA will not cover its cost of capital in 2020, more positively, the group’s capital position remains robust, after a strong capital market recovery in the second quarter. Several constituents demonstrated their financial flexibility by raising new funds, and others were successful in attracting new alternative capital to support their business positions, despite the challenging market conditions.”